Estimating lease-end costs: mileage, damage, and administrative fees

Lease returns often come with unexpected charges if you aren’t prepared. This summary outlines the common drivers of lease-end costs—excess mileage, damage and wear, and administrative or disposition fees—and previews inspection, repair, and documentation steps you can take to estimate likely charges before returning the vehicle.

Lease returns often trigger questions about how much you’ll owe and why. Estimating lease-end costs requires understanding how mileage overages, damage and wear assessments, depreciation and residual value interact with administrative fees and required paperwork. Preparing for inspection, documenting maintenance, and choosing between repairs or paying assessed charges can reduce surprises and help you weigh trade-in or purchase options with clearer expectations.

How does mileage affect leaseend charges?

Leases include a mileage allowance stated in the contract; exceeding it is one of the most predictable sources of additional cost. Lease companies calculate an excess mileage rate—typically a cents-per-mile amount—and apply it to miles beyond your limit. To estimate potential mileage charges, multiply your projected overage by the per-mile fee listed in your lease agreement. If you expect significant overage, consider negotiating a buyout or estimating the total overage cost compared with a one-time purchase or tradein offer.

How are inspection and wear assessed?

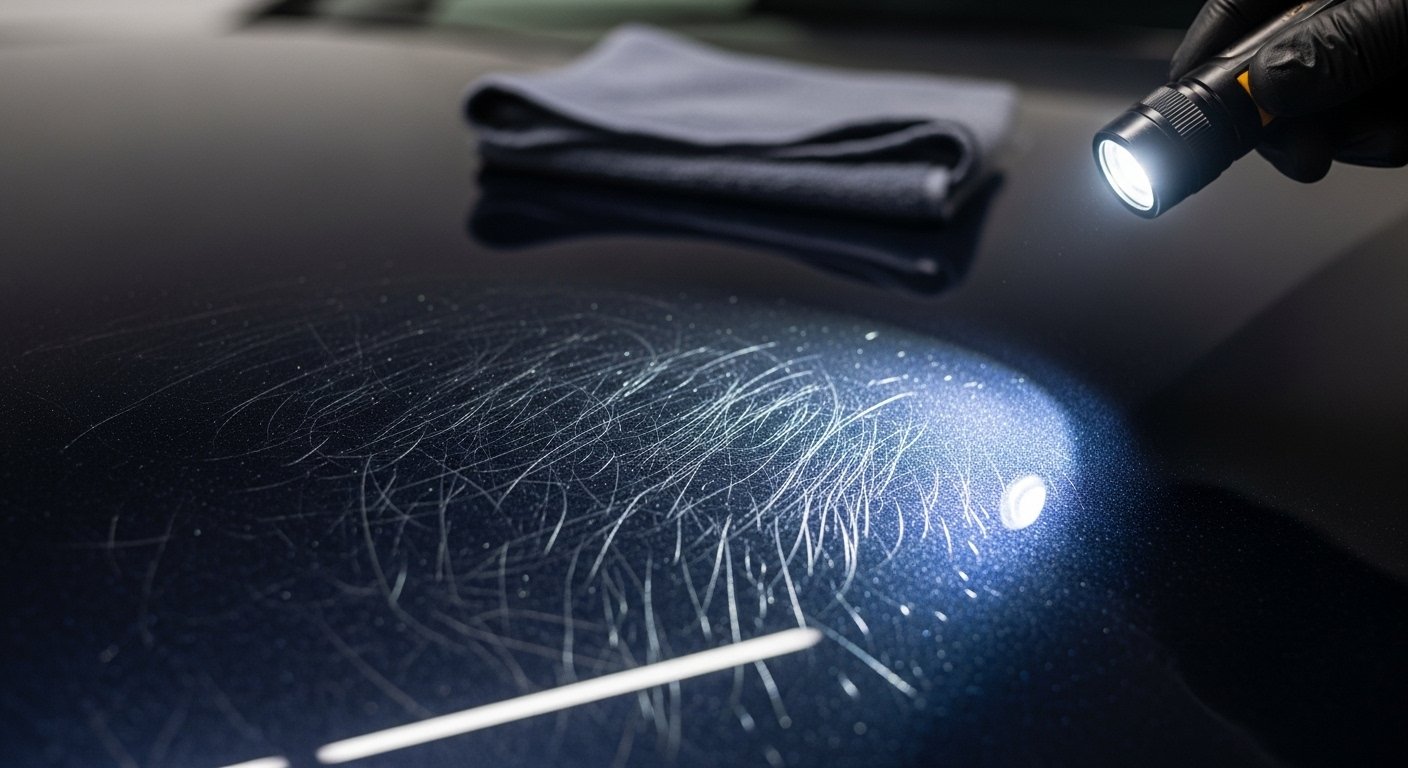

An inspection will classify damage as either acceptable wear or excessive wear and tear. Acceptable wear covers small nicks or minor tire scuffs; excessive wear includes large dents, broken parts, torn upholstery, or mechanical problems caused by neglect. Inspections are often done by third-party agents or the leasing company and may include a written report and photos. Document your vehicle’s condition before return—photos and dated service records can help dispute excessive charges or support a repair strategy that is more cost-effective than paying assessed fees.

How does depreciation and residual valuation work?

Residual value is the lease’s predicted future worth of the vehicle at lease-end and is set when the lease begins. Depreciation—the gap between the vehicle’s original value and its residual—affects purchase and tradein decisions. If the market value at lease-end exceeds the residual, buying out the lease can be advantageous; if it’s lower, the fee structure and possible wear charges will determine the net cost. Understanding residual and current market valuation helps you compare repair-and-return costs against tradein or purchase alternatives.

What maintenance, warranty, and repair factors matter?

Regular maintenance reduces the likelihood of repair charges, and remaining warranty coverage can offset costs for eligible repairs. Review the vehicle’s service history and warranty terms before the pre-return inspection. Small cosmetic issues are often cheaper to fix privately than to pay the leasing company’s marked-up repair rates. Detailing the car and addressing minor items such as windshield chips or light scratches with a reputable local service can lower assessed damage fees and improve tradein valuation.

What paperwork, fees, and documentation are required?

Administrative or disposition fees, title and registration paperwork, and any outstanding lease payments must be settled at lease-end. The lease agreement will list disposition or administrative fees; these vary by provider. Keep organized documentation—service invoices, warranty paperwork, and inspection photos—to speed the process and contest unjust charges. If you plan to trade in or purchase, request a final payoff figure and ensure documentation is complete for transfer, registration, and potential warranty transfers.

Real-world costs and provider comparison

Below is a concise comparison of common lease-end products and services with typical cost estimations to help you budget. These figures are general benchmarks or typical ranges and will vary by provider, location, and vehicle condition.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Disposition/administrative fee | Ally Financial (example) | $300–$400 (typical range) |

| Disposition/administrative fee | Toyota Financial Services (example) | $300–$400 (typical range) |

| Pre-return inspection | Local dealership or independent inspection | $0–$150; some dealers or leasing companies offer a complimentary check |

| Detailing and minor cosmetic repairs | National detailers / local mobile detailers | $75–$300 depending on scope and location |

| Pre-return mechanical repairs | Independent auto repair shop | $100–$1,000+ depending on severity |

| Trade-in appraisal | CarMax or franchised dealer | Free appraisal; trade-in value depends on condition and market |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Real-world cost insight: disposition fees commonly fall in the low hundreds, excess-mileage rates are usually listed per mile in the lease, basic detailing is often under a few hundred dollars, and mechanical repairs vary widely by issue. Use the table above to compare likely outlays and gather actual quotes from providers in your area to refine your estimate.

Returning a leased vehicle involves predictable and variable elements: per-mile excess charges, assessed damage or wear, and administrative fees combined with any unpaid balances. By documenting condition, completing recommended maintenance, obtaining pre-return inspections, comparing repair costs versus assessed fees, and reviewing residual value, you can form a practical estimate of lease-end costs and choose the most cost-effective path.

Conclusion

Estimating lease-end costs is a matter of understanding contract terms, anticipating inspection outcomes, and comparing repair or buyout options against fees and residual valuation. Organizing documentation, getting realistic quotes from local services, and knowing typical fee ranges will make the final accounting clearer and help you decide whether to return, repair and return, tradein, or purchase the vehicle.